Picture yourself cruising on the open highway, feeling the breeze through your hair, with limitless options in front of you. This is the sense of adventure and freedom that owning a camper brings. But the question arises, how can one manage to finance this dream? This is when the option of camper financing becomes relevant.

I’ve been there, wondering how I could make this dream a reality. In this article, I will guide you through the ins and outs of camper financing, helping you navigate the process with ease.

From determining your budget and researching different types of campers to finding a lender and negotiating the terms, I’ll break down every step for you.

We’ll explore the necessary documents, the application process, and how to manage your loan once it’s approved. So, buckle up and let’s dive into the world of camper financing, so you can finally hit the road and start making memories that will last a lifetime.

Key Takeaways

- Determining budget and evaluating financial situation is crucial in camper financing

- Research different types of campers and features to make an informed decision

- Compare lenders based on interest rates, loan terms, and reputation

- Review and compare loan offers, considering factors such as interest rates and overall cost of the loan

Determine Your Budget and Financing Options

So, let’s figure out how much you can afford and explore your financing choices!

Determining affordability is the first step when it comes to camper financing. You need to evaluate your financial situation and determine how much you can comfortably afford to spend on a camper. This includes considering your monthly income, expenses, and any existing debts or financial obligations. By understanding your budget, you can avoid overextending yourself and ensure that your monthly payments for the camper will fit within your means.

Once you have determined your budget, it’s time to explore loan options. There are various financing choices available for purchasing a camper. You can opt for a traditional bank loan, which typically offers competitive interest rates and flexible repayment terms. Another option is to consider financing through the dealership where you plan to purchase the camper. Dealerships often have partnerships with financial institutions and can help you secure a loan that suits your needs.

Additionally, you may want to research different types of campers that fit within your budget range. Understanding the different models, sizes, and features available will help you make an informed decision when it comes to selecting the right camper for you.

So, let’s move on to explore the various types of campers and find the perfect fit for your camping adventures!

Research Different Types of Campers

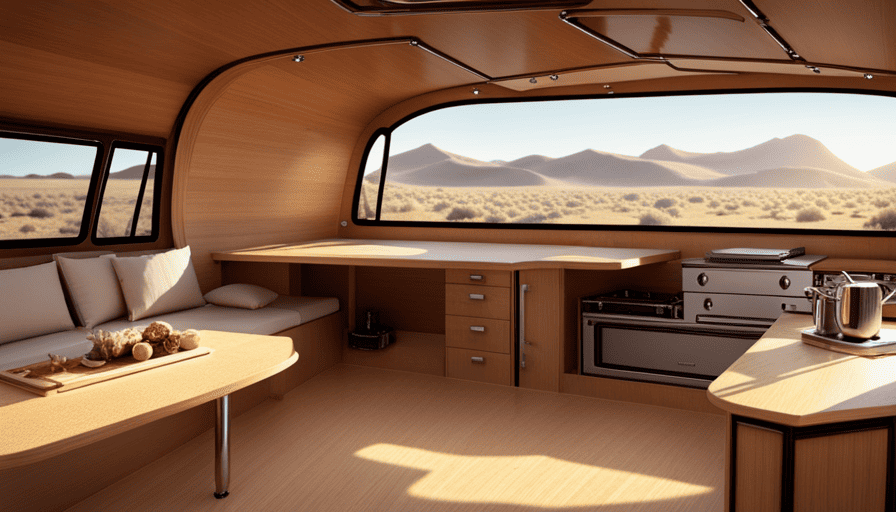

When exploring various types of campers, picture yourself wandering through a vast array of options, each one beckoning with unique features and possibilities. Researching different camper models is an essential step in the camper financing process. It allows you to determine which type of camper best suits your needs and preferences.

There are various types of campers, such as travel trailers, fifth wheels, pop-up campers, and motorhomes. Each type offers its own set of features and benefits. For example, travel trailers are towed by a vehicle and provide spacious living areas, while pop-up campers are lightweight and compact, perfect for those who prefer a more simplistic camping experience. It’s important to consider factors such as size, amenities, and durability when researching different camper models.

Furthermore, exploring different camper features is crucial in finding the perfect fit for your outdoor adventures. Features vary depending on the camper model and can include kitchens, bathrooms, sleeping areas, storage space, and entertainment systems. Assessing these features will help you determine which camper aligns with your lifestyle and camping goals.

In the next section, we will delve into finding a lender or financing institution that can assist you in making your camper dreams a reality.

Find a Lender or Financing Institution

Once you’ve chosen your ideal camper, the next step is to search for a lender or financing institution that can help turn your outdoor dreams into a reality. Finding a lender is an essential part of the camper financing process, and it’s important to take the time to research and compare different options.

Here are three key factors to consider when comparing lenders:

-

Interest Rates: Different lenders offer different interest rates, so it’s crucial to compare them to ensure you’re getting the best deal. Lower interest rates can save you money in the long run, so be sure to shop around and find the most competitive rates available.

-

Loan Terms: Look into the loan terms offered by different lenders. This includes the length of the loan and any specific requirements or restrictions. Understanding the terms will help you determine the affordability and flexibility of the financing options.

-

Customer Reviews and Reputation: Research the lender’s reputation by reading customer reviews and ratings. This will give you insights into their customer service, reliability, and overall experience.

By finding a lender that offers competitive interest rates, favorable loan terms, and has a positive reputation, you can ensure a smooth financing process for your camper purchase.

Once you’ve completed this step, you can move on to the next section, which involves gathering and preparing the necessary documents.

Gather and Prepare the Necessary Documents

To make your dream of owning a camper a reality, let’s dive into the important task of gathering and preparing the necessary documents – it’s a crucial step that will bring you closer to hitting the road and embracing the freedom of the great outdoors! When applying for camper financing, you’ll need to provide certain documents to the lender or financing institution. These documents serve as proof of your identity, income, and financial stability. By preparing them in advance, you can streamline the application process and increase your chances of approval.

Here is a table outlining the documents typically required for camper financing:

| Document | Description |

|---|---|

| Identification | Valid driver’s license or passport |

| Proof of Income | Recent pay stubs or tax returns |

| Employment Verification | Letter from employer confirming your job and income |

| Bank Statements | Three to six months’ worth of statements |

| Credit History | Credit report and score |

By having these documents ready, you can demonstrate to the lender that you meet their loan requirements. This will give you a better chance of securing the financing you need to purchase your dream camper.

Now that you have gathered and prepared the necessary documents, it’s time to move on to the next step: applying for financing.

Apply for Financing

Now it’s time to take the exciting step of applying for financing and getting one step closer to hitting the road in your dream camper!

When applying for camper financing, there are a few key factors to consider. First, you’ll need to determine if you meet the loan eligibility requirements set by the lender. These requirements may vary, but typically include factors such as a minimum age, a stable source of income, and a good credit history.

Speaking of credit, your credit score will play a crucial role in the financing process. Lenders often have credit score requirements that you must meet in order to qualify for a loan. It’s important to check your credit score beforehand and take steps to improve it if necessary.

Once you’ve gathered all the necessary documents and are confident in your loan eligibility and credit score, you can begin the application process. Be prepared to provide personal and financial information, such as your employment history, income details, and any existing debts.

Now that you understand the application process, let’s move on to the next section where we will review and compare loan offers.

Review and Compare Loan Offers

If you think that reviewing and comparing loan offers will be a breeze, you’re in for a surprise. It’s a crucial step in the camper financing process, and it requires careful consideration.

When reviewing loan offers, you should focus on two key aspects: loan comparison and interest rates.

Firstly, it’s essential to compare different loan options to determine which one best suits your needs. Look at factors such as the loan amount, repayment period, and monthly installments. Analyze the terms and conditions of each offer, paying attention to any hidden fees or penalties. Consider the overall cost of the loan and how it fits into your budget.

Secondly, pay close attention to the interest rates. A lower interest rate means you’ll pay less in the long run. Compare the rates offered by various lenders and weigh the pros and cons. Keep in mind that interest rates can vary based on factors like your credit score and the loan term.

Once you’ve thoroughly reviewed and compared the loan offers, you’ll be better prepared to negotiate the terms and interest rates in the next step.

Negotiate the Terms and Interest Rates

When it comes to negotiating the terms and interest rates, you’ll want to put your best foot forward and show lenders why you’re a smart and reliable borrower. Here are some tips and strategies to help you navigate this process:

-

Do your research: Before entering negotiations, gather information about current interest rates and loan terms. This will give you a benchmark to work from and help you understand what’s reasonable to ask for.

-

Highlight your strengths: Emphasize your creditworthiness and financial stability to lenders. Provide them with documentation, such as proof of income and a good credit score, to demonstrate your ability to repay the loan.

-

Be prepared to negotiate: Don’t be afraid to negotiate the terms and interest rates. Come prepared with alternative offers from other lenders and use them as leverage to negotiate a better deal.

By following these tips, you can increase your chances of securing favorable terms and interest rates for your camper financing. Once you’ve successfully negotiated a suitable agreement, you can then move on to finalizing the financing process. Before finalizing the financing process, be sure to carefully review all of your camper loan options. Compare different lenders and their terms to ensure you are getting the best deal possible. It’s important to consider factors such as the length of the loan, the interest rate, and any potential fees associated with the loan. Taking the time to thoroughly research and compare your options can save you money in the long run and make the process of securing camper financing a smooth and successful one.

Finalize the Financing Agreement

Once you’ve successfully negotiated a suitable agreement, it’s time to seal the deal and finalize your financing agreement for the camper of your dreams. This step is crucial as it ensures that both parties are on the same page and have a clear understanding of the terms and conditions.

When finalizing the financing agreement, it’s important to carefully review all the details discussed during the negotiation process. Pay close attention to the interest rate, loan duration, and any fees or charges associated with the loan. Make sure that everything is clearly stated in the agreement to avoid any confusion or misunderstandings in the future.

In addition to reviewing the terms, it’s also essential to understand your responsibilities as a borrower. The financing agreement will outline the terms of the loan, including the amount borrowed, repayment schedule, and consequences for late or missed payments. It’s crucial to be aware of these terms and to make regular payments on time to avoid any negative impact on your credit score.

Once you have finalized the financing agreement, it’s important to make regular payments and manage your loan effectively. This involves setting up automatic payments or reminders to ensure that you never miss a payment. By staying organized and proactive in managing your loan, you can ensure a smooth and successful repayment process.

In the next section, we’ll discuss how to make regular payments and manage your loan effectively, ensuring that you stay on top of your financial obligations.

Make Regular Payments and Manage Your Loan

To effectively manage your loan and ensure timely payments, it’s imperative that you establish a system for regular payments and stay proactive in meeting your financial obligations.

Managing loan payments requires careful planning and organization. First, determine the best repayment option for your situation. Some lenders offer flexible repayment plans, such as monthly, bi-weekly, or weekly payments. Choose a plan that aligns with your budget and allows you to make consistent payments without straining your finances.

Next, set up automatic payments if possible. This ensures that your payments are made on time and eliminates the risk of forgetting or missing a payment. If automatic payments aren’t available, create reminders or alerts on your phone or calendar to prompt you to make the payment manually.

Additionally, consider making extra payments whenever possible. This can help you pay off your loan faster and reduce the overall interest you’ll pay.

Remember to keep track of your loan balance and interest rate. Understanding these details will help you stay informed about your progress and make informed decisions regarding your loan.

If you encounter any financial difficulties, communicate with your lender promptly. They may be able to offer alternative repayment options or provide guidance on managing your loan during challenging times.

By effectively managing your loan payments, you can ensure a smooth and successful repayment process. Once your loan is paid off, you’ll be able to enjoy your new camper and hit the road with peace of mind.

Enjoy Your New Camper and Hit the Road!

Now that you’ve successfully managed your loan payments and taken care of your financial obligations, it’s time to savor the freedom and excitement of hitting the road in your brand new camper!

Traveling in a camper opens up a world of possibilities and allows you to explore new places, experience different cultures, and create lasting memories. Here are some traveling tips to ensure a smooth journey:

-

Plan your route: Before setting off, research the best routes to your desired destinations. Consider factors like road conditions, scenic routes, and attractions along the way. This will help you make the most of your travel experience.

-

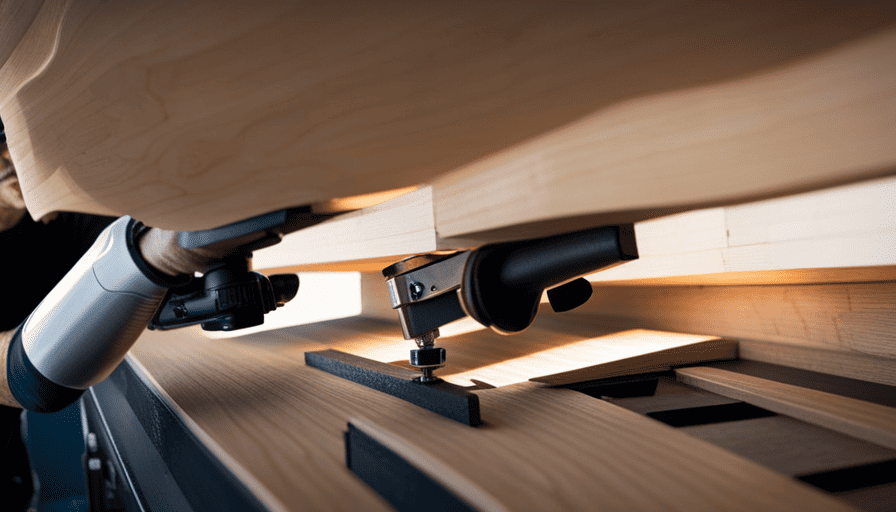

Take care of maintenance: Regular maintenance is crucial to keep your camper in optimal condition. Schedule regular check-ups for the engine, tires, and electrical systems. Also, don’t forget to clean the interior and exterior regularly to maintain its appearance.

-

Be prepared for repairs: Despite regular maintenance, unexpected repairs may still arise. It’s essential to have a contingency plan and carry basic tools, spare parts, and emergency supplies. Familiarize yourself with troubleshooting techniques and have a list of reliable repair shops in the areas you plan to visit.

By following these traveling tips and staying on top of maintenance and repairs, you can fully enjoy the freedom and flexibility that comes with owning a camper. So, buckle up and get ready for an adventure-filled journey!

Frequently Asked Questions

What are the average interest rates for camper financing?

On average, interest rates for camper financing can vary depending on various factors. Typically, rates range from 4% to 10%.

However, it’s important to note that these rates are subject to change based on individual creditworthiness, loan terms, and the lender’s policies. When exploring financing options, it’s crucial to compare rates from different lenders to secure the best deal.

Remember to consider the total cost of the loan, including any additional fees or charges.

Can I finance a camper if I have bad credit?

Yes, you can still finance a camper with bad credit. One option is to get a camper loan with a cosigner. A cosigner with good credit can help increase your chances of approval and secure a better interest rate.

However, there are requirements for camper financing with bad credit. Lenders may consider factors such as income, employment history, and debt-to-income ratio. It’s important to research different lenders and compare their terms to find the best option for you.

Is it possible to finance a used camper?

Yes, it’s possible to finance a used camper.

When considering financing options, there are several benefits to financing a used camper. Firstly, a used camper typically has a lower purchase price compared to a new one, making it more affordable.

Additionally, financing a used camper allows you to spread out the cost over a period of time, making it easier to manage your budget. This can be especially helpful if you have a limited budget or are looking to save money.

Are there any additional fees or charges associated with camper financing?

When it comes to camper financing, it’s important to consider any additional fees or hidden charges that may be associated with the loan. These fees can vary depending on the lender and the terms of the loan.

Some common fees may include origination fees, application fees, and prepayment penalties.

It’s essential to carefully review the loan agreement and ask the lender about any potential fees or charges to ensure you have a clear understanding of the total cost of financing your camper.

How long does the camper financing process typically take?

On average, the camper financing process typically takes about 2 to 4 weeks from start to finish. However, it’s important to note that this timeline can vary depending on various factors such as the complexity of the loan, the lender’s efficiency, and the completeness of the required documentation.

Speaking of which, common documents needed for camper financing include proof of income, identification, credit history, and the details of the camper you intend to purchase.

Conclusion

In conclusion, financing a camper can be a complex process, but with the right research and preparation, it can be a rewarding experience.

It is important to determine your budget and explore different financing options to find the best fit for your needs.

One interesting statistic to consider is that, according to a recent study, the average loan term for camper financing is around 10 years, allowing borrowers to spread out their payments and make them more manageable.

By carefully managing your loan and making regular payments, you can enjoy the freedom of hitting the road in your new camper.